Domestic semiconductor production boosted through tax incentives

Domestic semiconductor production boosted through tax incentives enhances local economies, drives technological innovation, and supports job creation, positioning companies to compete effectively in a rapidly evolving global market.

Domestic semiconductor production boosted through tax incentives is a game-changer for tech industries. Have you wondered how these incentives can reshape the landscape and drive innovation? Let’s dive into it!

Understanding the benefits of tax incentives

Understanding the benefits of tax incentives is crucial for maximizing investment in the semiconductor industry. These incentives can significantly impact production costs, making it easier for companies to thrive.

One benefit of tax incentives is the ability to reduce operational expenses. Companies can allocate these savings towards research and development, which is essential in the competitive semiconductor market. Furthermore, tax breaks can help attract talent by enabling companies to offer more attractive salaries and benefits.

Key Advantages of Tax Incentives

Tax incentives often lead to a ripple effect in local economies. As semiconductor manufacturers grow, they create jobs and stimulate demand for local suppliers.

- Lower production costs leading to increased profitability.

- Enhanced R&D capabilities allowing for innovation.

- Job creation in the local community.

- Improved competitiveness in the global market.

This interconnected growth can foster a more vibrant local economy as new businesses emerge to support the expanding semiconductor sector. Additionally, tax incentives can encourage existing companies to upgrade their technology, facilitating advancements in efficiency and process innovation.

Investment in domestic semiconductor production spurred by favorable tax policies not only benefits individual companies but also fortifies the entire industry against international competition. As the landscape of global technology continues to evolve, understanding these benefits remains vital for stakeholders aiming to innovate and lead.

How tax incentives impact semiconductor production

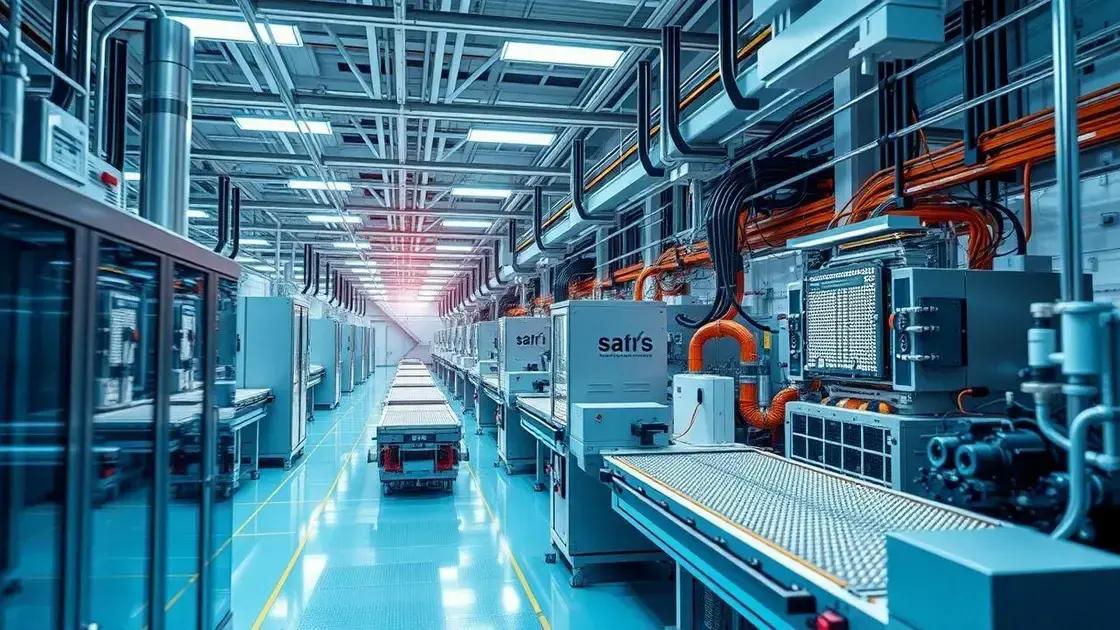

Tax incentives significantly impact semiconductor production, helping companies boost their output and innovate. By reducing financial burdens, these incentives encourage businesses to invest in state-of-the-art technology.

When companies take advantage of tax breaks, they can redirect funds into expanding facilities or enhancing production capabilities. This growth often results in higher yields and a more efficient manufacturing process. As the industry evolves, having access to modern technology becomes crucial.

Positive Effects on Production

Additionally, tax incentives foster a culture of innovation. With financial resources freed up, companies are more willing to explore new materials and techniques that can revolutionize semiconductor manufacturing.

- Increased capital for research and development.

- Ability to hire skilled workers to improve processes.

- Potential for collaboration with local universities.

- Development of sustainable production practices.

These factors combine to create a robust manufacturing environment. As competition grows, companies that capitalize on tax incentives can position themselves advantageously in the global market. They are better equipped to respond to technological advances and consumer demands.

Moreover, tax incentives can attract foreign investments, leading to a more vibrant semiconductor ecosystem. This influx can spur further advancements in domestic production and expand the industry’s overall capacity.

Case studies of boosted domestic production

Case studies of boosted domestic production provide valuable insights into how tax incentives have transformed the semiconductor industry. These examples show the profound impact of policy on local economies.

One notable case is a semiconductor company that leveraged tax rebates to expand its manufacturing facility. This expansion resulted in increased production capacity and allowed the company to hire additional skilled workers. As a result, local job opportunities surged.

Examples of Successful Initiatives

Another example includes a partnership between a semiconductor firm and a research university. This collaboration was made possible by government support, which facilitated research into innovative technologies.

- Increased research funding led to breakthrough innovations.

- Development of cutting-edge products to compete globally.

- Strengthening ties between academia and industry.

- Creation of specialized training programs for students.

These case studies demonstrate that when companies and educational institutions work together, they can drive significant advancements in production. The infusion of tax incentives can enable this partnership to flourish, creating a win-win for both sectors.

Moreover, these success stories inspire other businesses to pursue similar paths, ultimately leading to a richer ecosystem for semiconductor production in the domestic market. More companies are now considering how tax incentives can enhance their operational strategy.

Future trends in semiconductor industry growth

Future trends in the semiconductor industry show a bright path filled with opportunities and advancements. As technology evolves, the demand for semiconductors continues to rise across various sectors.

One major trend is the shift toward smaller, more efficient chips. These chips are critical for devices like smartphones, laptops, and IoT devices. Companies are investing heavily in research to create smaller and faster semiconductors that consume less power.

Emerging Technologies Shaping the Future

Another key trend is the integration of artificial intelligence (AI) and machine learning in semiconductor design and manufacturing. AI-driven solutions can optimize production processes, allowing faster and more accurate chip development.

- Improved manufacturing efficiency through automation.

- Advanced materials used for better performance.

- Collaboration between tech companies and universities for innovation.

- Focus on sustainable and environmentally friendly production methods.

Additionally, the industry is seeing a move toward sustainability as companies aim to reduce their environmental impact. This involves adopting eco-friendly materials and waste reduction strategies. Innovations in recycling and reusing semiconductor materials are becoming more common.

Societal demands for smart devices also drive trends in the semiconductor sector. As more people rely on technology for daily tasks, manufacturers are pushed to keep up. This ongoing demand compels the industry to innovate continuously, ensuring that production meets consumer expectations.

FAQ – Frequently Asked Questions about Domestic Semiconductor Production

What are tax incentives in semiconductor production?

Tax incentives are financial benefits provided by the government to encourage companies to invest in domestic semiconductor manufacturing.

How do tax incentives impact local economies?

They drive job creation, encourage innovation, and attract more businesses to the area, creating a thriving ecosystem.

What trends are shaping the future of the semiconductor industry?

Key trends include advancements in AI integration, sustainability efforts, and the demand for smaller, more efficient chips.

Why is sustainability important in semiconductor manufacturing?

Sustainability helps reduce environmental impact and can improve public perception and consumer demand for greener technologies.